It should add clarity not confusion. A merger happens when a company finds a benefit in combining business operations with another company in a way that will contribute to increased shareholder value.

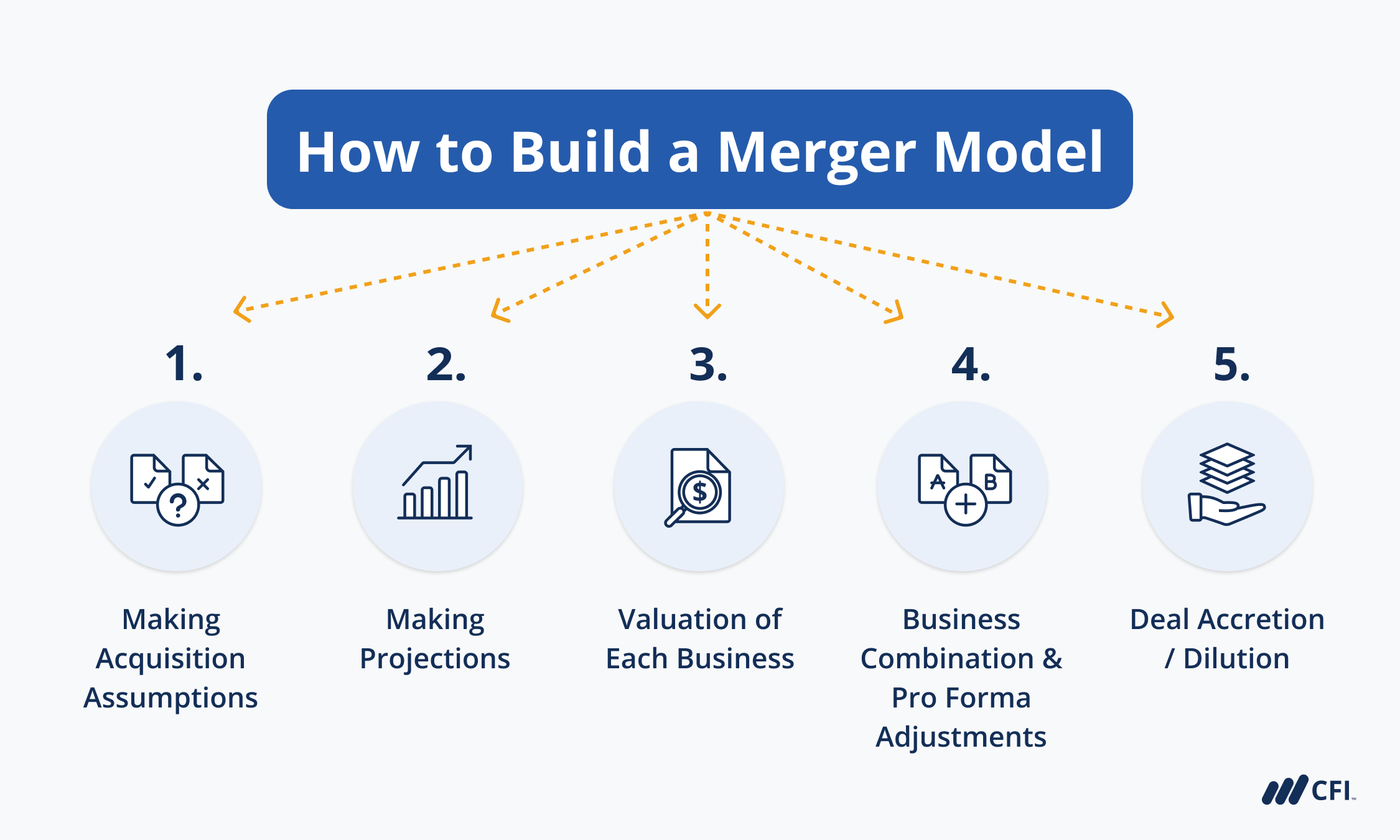

How To Build A Merger Model A Basic Overview Of The Key Steps

A merger will take longer than you expect.

. Leverage frequent communications and continuous listening strategy to address new questions or concerns. In cooking when you want to merge two ingredients you mix them. We spoke with three experts about the most effective ways to merge brands.

In the recursive function if the value of k is 1 then return the array else if the value of k is 2 then merge the two arrays in linear time and return the array. Two companies combine to form one legal entity and the target companys stockholders receive cash buyer company stock or a combination. - Selecting which brand assets to keep and which to jettison - Implementing internal and external messaging about the merger - Refining the visual identity of.

You cant put former competitors together and expect them to get along from day one. A merger provides a unique opportunity to transform a newly combined organization to shape its culture in line with strategic priorities and to ensure its health and performance for years to come. Also known as investment bankers mergers and acquisitions experts act as financial consultants when one company acquires another company or when two or more companies merge into one.

Find out how to address merger issues such as. Think about what each audience needs to hear and how it would be best delivered. When mergers and acquisitions occur it is important that while 11 3 or more the share of synergy is made should be divided up accordingly ex.

By establishing a clear fact base and understanding of the existing company cultures leaders can use a common language to set the cultural direction for. It is of utmost importance to merge the team of employees first and foremost. However there are now three major differences with the walk me through your resume question.

So you think you want to be a mergers and acquisitions expert. Hope this word list had the. Merger Three basic structures all of which involve statutory mergers in which Sellers outstanding stock is converted into the right to receive stock of Buyer cash or other consideration.

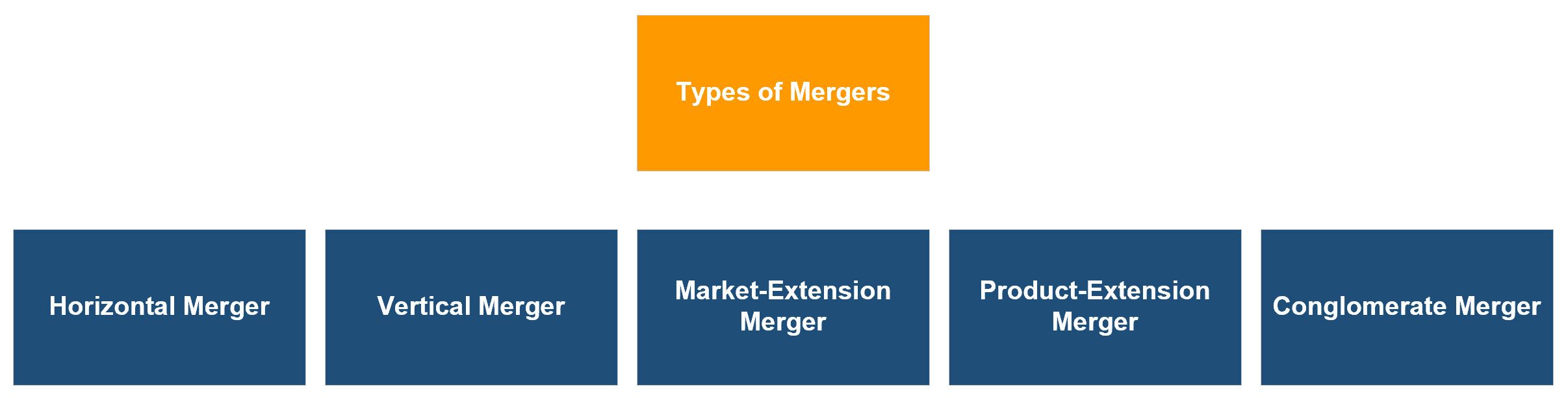

The term chosen to describe the merger depends on the economic function purpose of the business transaction and relationship between the merging companies. Effective way of completing acquisition of a company with a large. The Sloan School of Management was.

Conglomerate merger horizontal merger market extension merger vertical merger and product extension merger. A key advantage of a merger is that it generally requires consent of only a majority of the target companys stockholders it could be a good choice when the target company has multiple stockholders. Theyre used to thinking of each other as the enemy sometimes.

If the value of k is greater than 2 then divide the group of k elements into two equal halves and recursively call the function ie 0 to k2 array in one recursive function and k2 to k array in another recursive function. You Must Be More Concise We. You Must Have Previous Experience Whether youre an undergrad or a career changer at the MBA level you need previous finance experience ie a sequence of internships to have any chance of getting into IB.

This reference page can help answer the question what are some adjectives commonly used for describing MERGER. Other alternative models which fall short of a merger asset purchase or joint venture are also used to realize the benefits of a transaction without a change in ownership or corporate structure. The easiest way I can think of to describe a merger is equate it to a recipe.

An example is a management services agreement pursuant to which a health system manages an independently owned hospital for a fee. In an MA situation the two merging companies will present two different ways of organizing so these plus a combination of the best of both provide three obvious options. The best way to think about horizontal mergers is to look at how startup companies get acquired by larger companies either to absorb their technology - which can be used by the larger company to fill a gap they have - or because they are posing a threat and have somehow captured part of the market that the bigger company has been trying to.

The split in in shares does not matter but each party should earn a fraction that is greater than the value they produced prior to the merger. MIT Sloan School Of Management. In business it is the same way.

There are five commonly-referred to types of business combinations known as mergers. A merger or acquisition can signal a need to refresh your resume. As financial consultants these experts provide advice to clients on how to handle the merger and.

Stronger companies merge with weaker competitors to gain market share. One of the top business schools in America located at the Massachusetts Institute of Technology in Cambridge Massachusetts. They have to understand why a merger is necessary or desirable and in their best interest.

Types Of Mergers Learn About The Different Types Of M A

6 Key Responsibilities Of Mergers And Acquisitions Lawyers Law Firm Merger Good Lawyers

5 Tips For Hr During Mergers Acquisitions Infographic Agile Project Management Agile Project Management Templates Project Management Templates

0 Comments